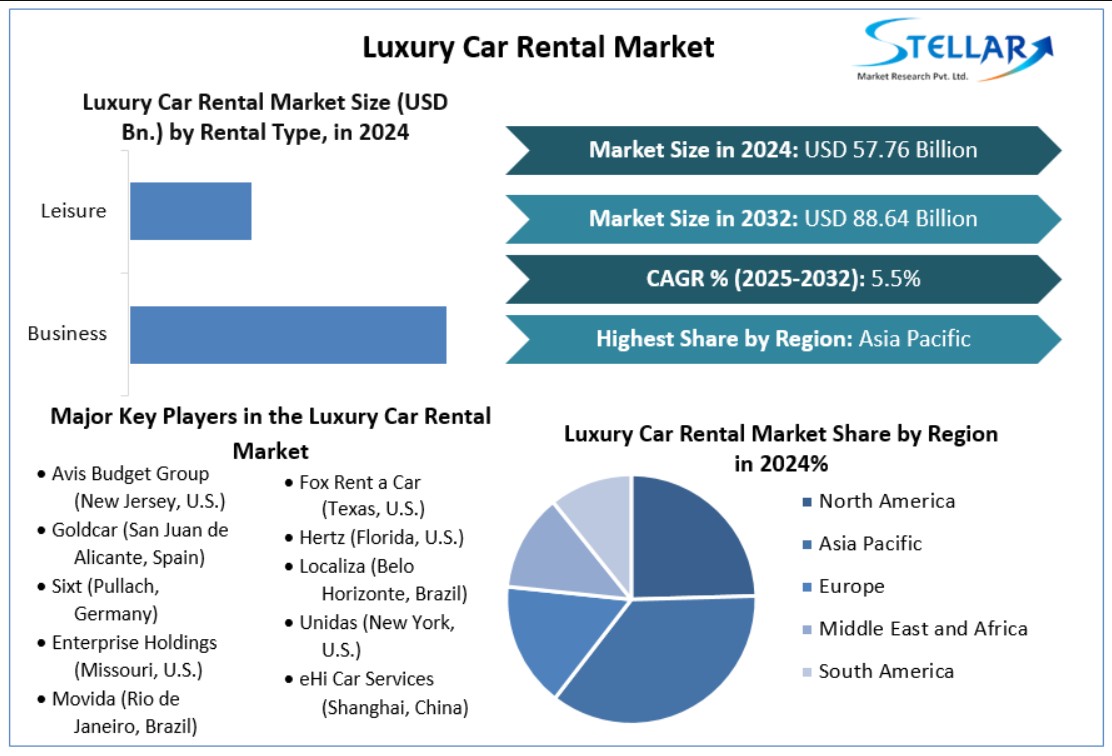

Luxury Car Rental Market was valued at USD 57.76 billion in 2024. Global Luxury Car Rental Market size is estimated to grow at a CAGR of 5.5 % over the forecast period.This growth is fueled by rising disposable incomes, demand for luxury experiences, increasing tourism, and the widespread availability of app-based rental platforms.

Free Sample Copy: https://www.stellarmr.com/report/req_sample/luxury-car-rental-market/2554

- Market Estimation & Definition

Luxury car rentals refer to the short-term or long-term leasing of high-end, premium vehicles that fall into categories like executive sedans, SUVs, sports cars, and exotic models. This service caters to:

- Affluent consumers

- Corporate clients

- Event planners

- Travelers seeking comfort and prestige

Luxury car rental services are usually offered through dedicated agencies, online travel portals, and car-sharing platforms. With brands like BMW, Mercedes-Benz, Audi, Rolls Royce, Lamborghini, and Tesla dominating the fleet, the market serves consumers who value status, performance, and exclusivity.

Free Sample Copy: https://www.stellarmr.com/report/luxury-car-rental-market/2554

- Market Growth Drivers & Opportunities

Rise in Global Tourism and Business Travel

Post-pandemic recovery in international tourism, along with increased business travel and corporate events, is creating demand for luxury car rentals. High-net-worth individuals and executives prefer luxury cars for comfort, privacy, and brand status.

Experience-Based Consumption

Millennials and Gen Z consumers are increasingly renting over owning, especially for unique experiences. A luxury car rental offers an aspirational experience, perfect for weddings, honeymoons, red-carpet events, and leisure travel.

App-Based Aggregators and Digital Transformation

The expansion of online booking portals, AI-powered fleet management, and instant booking apps have made luxury cars more accessible, allowing real-time availability and flexible usage models.

Emergence of Electric Luxury Vehicles

Luxury electric vehicles (EVs) like Tesla Model S, Lucid Air, and Porsche Taycan are entering the rental fleet, catering to eco-conscious high-end consumers, while supporting sustainability trends.

Corporate Leasing and VIP Transport Services

Enterprises are increasingly using luxury car rentals for executive mobility, client hosting, and event transportation. Long-term leasing models are emerging as attractive alternatives to ownership.

- Segmentation Analysis By Booking Mode

- Online

- Offline

- Online booking dominates due to digital transformation and the convenience of app-based services, real-time vehicle tracking, and flexible rental options.

- Offline channels still hold relevance in airports, premium hotels, and event-based rentals, where personalized service is prioritized.

By Vehicle Type

- Luxury Sedans

- Luxury SUVs

- Luxury Sports Cars

- Luxury sedans such as BMW 7 Series or Mercedes S-Class lead due to their popularity among business travelers.

- Luxury SUVs (e.g., Range Rover, Audi Q7) are gaining momentum, especially in adventure and family travel categories.

- Luxury sports cars cater to a niche but high-margin segment for thrill-seekers and high-profile events.

By End User

- Self-Driven

- Chauffeur-Driven

- Self-driven rentals dominate the segment, especially in developed economies where customer confidence in navigation and safety is higher.

- Chauffeur-driven services are rising in Asia-Pacific and the Middle East, catering to VIPs and events.

- Country-Level Analysis

🇺🇸 United States

- The U.S. holds a significant market share due to:

- A large base of affluent consumers

- Strong presence of premium rental services (Hertz Dream Collection, Enterprise Exotic)

- High volumes of business travel and domestic tourism

- Tech-savvy consumers are increasingly booking Tesla and Porsche rentals via platforms like Turo and Sixt.

🇩🇪 Germany

- As the home of automotive excellence, Germany has a thriving luxury car culture.

- Tourists flock to rent German brands like BMW, Audi, and Mercedes-Benz for Autobahn experiences.

- Strong infrastructure, customer service culture, and OEM tie-ins boost the German rental market.

- Business and exhibition tourism in cities like Frankfurt and Berlin also contribute to rental volumes.

- Commutator (Competitive) Analysis

The luxury car rental market is highly fragmented, featuring a mix of:

- Global car rental companies

- Luxury-specific agencies

- Tech-based aggregators

- OEM-operated rental programs

Key Players:

- Hertz Global Holdings

- Sixt SE

- Avis Budget Group

- Enterprise Holdings

- Turo (peer-to-peer)

- eHi Car Services

- Lurento

- BMW Rent, Mercedes-Benz Rent (OEM programs)

Competitive Trends:

- Sixt and Hertz are expanding their luxury fleets and offering EVs and subscription-based rentals.

- Turo is disrupting traditional rental models with its peer-to-peer sharing economy, allowing individuals to rent their luxury vehicles.

- Luxury travel companies are integrating car rentals into all-inclusive experiences, combining hotels, chauffeurs, and concierge services.

- Companies are investing in fleet modernization, including electric luxury vehicles and AI-powered vehicle monitoring.

- Conclusion

The Luxury Car Rental Market is cruising toward an era of digital convenience, experience-driven consumption, and sustainability. With a projected market size of USD 74.61 billion by 2030, the segment is no longer limited to the elite few—it is becoming an aspirational choice for a broader consumer base.

Key takeaways for stakeholders:

- Tech integration is key—mobile apps, fleet management systems, and real-time data are now baseline expectations.

- Electric luxury vehicles are not just a trend but a demand. Operators should electrify their fleets to stay competitive.

- Tourism recovery, corporate mobility, and event-based consumption will continue to drive demand globally.

As travel and lifestyle expectations evolve, luxury car rental services will be defined by customization, accessibility, and sustainability, delivering unparalleled experiences across segments and geographies.

About Us:

Stellar Market Research is a leading India-based consulting firm delivering strategic insights and data-driven solutions. With 119 analysts across 25+ industries, the company supports global clients in achieving growth through tailored research, high data accuracy, and deep market intelligence, serving Fortune 500 companies and maintaining strict client confidentiality.

Address

Phase 3, Navale IT Zone, S.No. 51/2A/2, Office No. 202, 2nd floor, Near, Navale Brg, Narhe, Pune, Maharashtra 411041

Mobile

+91 9607365656